How Have Marketing Budgets Changed in 2024 (Based on the Data)

- dhruvwalia2019

- May 20, 2024

- 4 min read

Gartner just released it's annual report on marketing budgets - and there's a lot of great data in their that confirms a lot of what us marketers have been feeling.

Overall, the data suggests teams have shrunk, channel spend has shifted to new forms of advertising, and the decline of martech budgets.

While this post will give you a good sense of what’s in the report, I highly recommend reading it for yourself.

(1) "Budgets are shifting to ads" is a phrase I’ve heard in almost every recession but this is more true for 2024 than it ever has been in recent years.

"Digital dominates a growing share of paid media spend, taking 57.1% of budgets in 2024, up from 54.9% in 2023. Top channels include search (13.6%), social advertising (12.2%) and digital display advertising (10.7%). Among offline channels, event marketing (17.1%), sponsorship (16.4%) and TV (16%) were the top channels for investment. Among offline channels, event marketing (17.1%), sponsorship (16.4%) and TV (16%) were the top channels for investment."

(2) Overall marketing budgets are also down.

"Average marketing budgets have fallen to 7.7% of overall company revenue, down from 9.1% in 2023, according to a Gartner, Inc. survey of 395 CMOs and marketing leaders."

And remember, this is a continuation of last year's decline.

"The Fall 2023 edition of The CMO Survey reported a 15% drop in marketing budgets as a percentage of company revenues, from 10.9% to 9.2%."

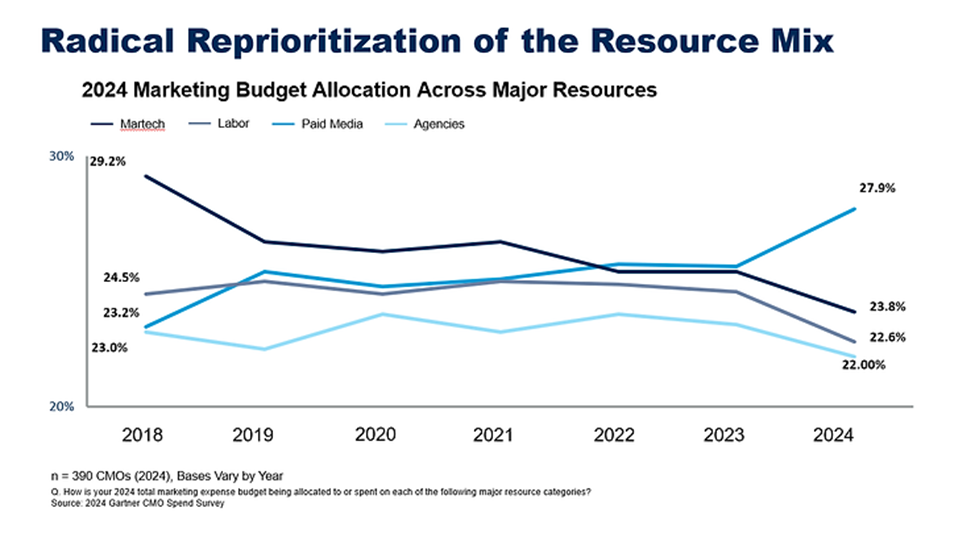

(3) MarTech spend is on the decline.

"Marketing technology’s percentage of marketing budgets fell to 23.8% this year, down from about 25.4% in 2023, according to Gartner’s 2024 CMO Spend Survey. Spending also fell for staff and agencies, while paid media grew, going from 25.6% last year to 27.9% in 2024."

I think this stat confirms a lot of what marketers and martech vendors have been feeling in recent months. Executive teams are quite simply not willing to spend as much on swanky new marketing technology or new hires as they would for a new, untested ad format, which can see ROI a lot more quickly.

About a year ago Gartner released a shocking stat that:

"The 2023 Gartner Marketing Technology Survey had a shocking finding that most large marketing organizations feel they are utilizing only 33% of their existing martech capabilities — a dramatic drop from the already worrisome 42% in 2022 and 58% in 2020"

What does this tell me? Marketers aren't always using tools they have access to. So 2/3s of the functionality in martech platforms are useless to them (which probably explains the declining investment).

So overall, investments are down in marketing teams and technology, but growing for advertisements.. I wonder what impact this will have on the structure of marketing teams in 5-10 years.

That also begs the question - where is marketing spend headed, within advertising?

Growing Platforms & Channels for Advertising in 2024

Another study on growth marketing trends found that:

"Respondents indicated they expect measurement to be a casualty of the changing privacy landscape. Over half (57%) of those surveyed believe it will be harder to capture reach and frequency while 73% believe their ability to attribute campaigns, track performance and measure ROI will be reduced."

It further stated:

"Another key finding is that 90% of ad buyers are shifting personalization tactics as a result of increased privacy legislation and signal loss, with ad budgets increasingly allocated to channels that can leverage first-party data, such as CTV, retail media and social media."

So marketers and advertisers are moving to what have been called “walled gardens” that enable highly targeted advertising, due to the growing restrictions around digital privacy. Well, at least they claim to be highly targeted but we have no way of validating that either way.

What are some examples of these new channels for advertising?

CTV is still growing, albeit at slower rates

“Advertiser Perceptions (AP)’s inaugural quarterly U.S. Advertising Market Outlook report found the growth rate for CTV ad spend slowed in 2023 compared to prior years but was still up more than 14% to $18.46 billion. In 2024 that’s expected to expand further to reach $21.45 billion in U.S. CTV ad spend this year A new forecast from Advertiser Perceptions projects 16.2% U.S. ad spend growth for connected TV in 2024, boosted by political advertising and the Olympics”

Continued explosion of retail media networks

“Worldwide retail media spend will hit $140 billion this year, according to our December 2023 forecast.”

“With a growth of 21.8%, retail media is growing faster than almost any other form of ad spend.”

“Amazon will account for 74.2% of retail media ad spend in the US, per our October 2023 forecast, but about 42% of retail media ad spend worldwide.”

Podcast ads are also a growing segment

“Advertisers will spend $2.37 billion on podcasts in 2024, marking 19.1% YoY growth, according to an October 2023 EMARKETER forecast. Of that amount, 9.3% will be purchased programmatically, amounting to $220.0 million. By 2026, podcast ads will pass the $3 billion milestone, accounting for 35.0% of spend on total digital audio services.”

Concluding Thoughts

So overall in 2024, we see:

A shift towards leaner marketing teams

Decreasing spend on marketing technology and the channels those tools support

An emphasis on advertising for customer acquisition

The growth of new advertising platforms for CTV, retail media, and other niche online ad networks

I’ve also been hearing more and more about different ways of capturing emails for retargeting. While these run into compliance issues in places like the EU and Canada, I believe they’re powerful tools that can complement advertising really well. I’ll talk about these next time

Comments